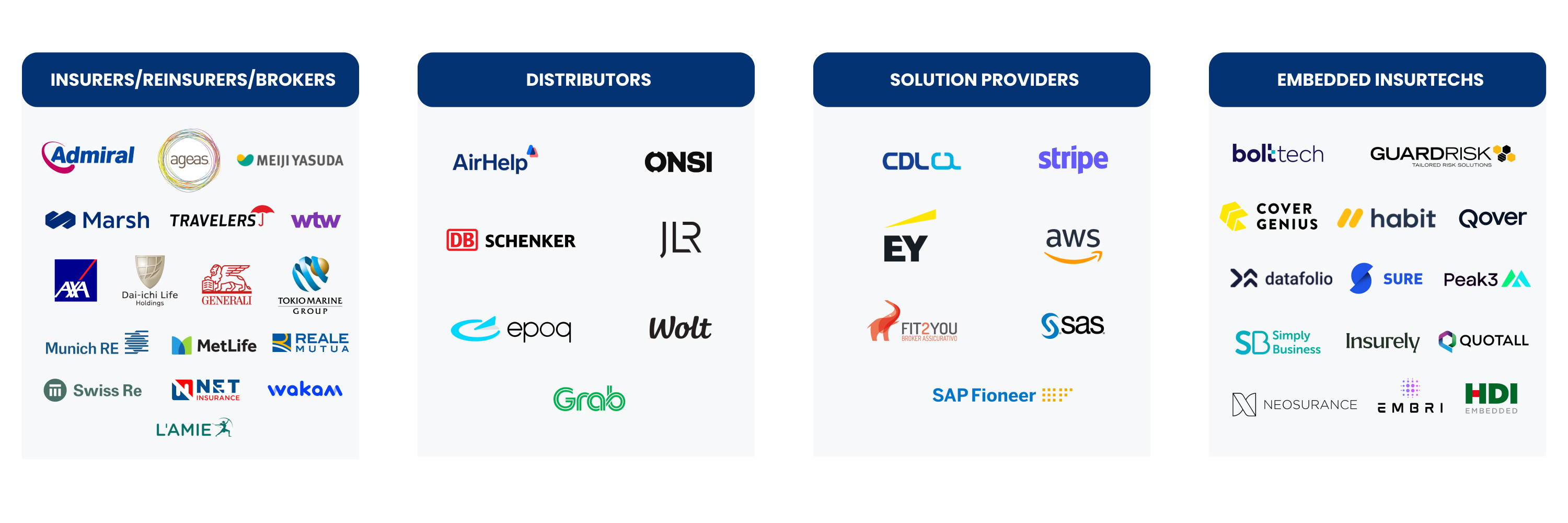

We gather leading insurance and non-insurance companies to network and exchange knowledge and expertise, so that we enable our members to stay ahead in a rapidly evolving and competitive business environment

The Open and Embedded Insurance Observatory performs research and advisory on the global applications of Open and Embedded insurance. Purpose of the Observatory is to co-create and strengthen the knowledge base on Open and Embedded insurance, and to facilitate and promote their adoption in the market.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Maecenas eget nulla bibendum, semper nisi sed, volutpat massa.

The distribution partner integrates the insurance services into its open technology systems.

The data provider captures meaningful insurance data from different sources.

Tech enablers play an essential role in simplifying and facilitating integration and the use of data.

The insurance provider integrates the data and embeds their services through APIs.

Our members get exclusive access to research and market intelligence and get actionable insights, data, and recommendations to support their embedded insurance initiatives.

Individual workshops with insurance and non-insurance brands, and training courses for internal insurance teams.

We co-create thought leadership content with our members, and support their marketing and communications by amplifying their content on LinkedIn and in our newsletter.

Gain immediate access to our invite-only annual plenary meetings in Europe, USA and Asia.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Maecenas eget nulla bibendum, semper nisi sed, volutpat massa. Suspendisse egestas purus mauris.

Aenean egestas metus et magna pretium lacinia. Aenean vitae metus tortor. Sed vel quam quam. Fusce dignissim libero quis varius fermentum. Ut eget porttitor orci, vel porta massa. Aliquam posuere nulla mi, eu vestibulum nisi pellentesque sit amet. Aliquam venenatis tellus eu ipsum faucibus mattis. Phasellus gravida vitae lacus sit amet tincidunt.

Aenean egestas metus et magna pretium lacinia. Aenean vitae metus tortor. Sed vel quam quam. Fusce dignissim libero quis varius fermentum. Ut eget porttitor orci, vel porta massa. Aliquam posuere nulla mi, eu vestibulum nisi pellentesque sit amet. Aliquam venenatis tellus eu ipsum faucibus mattis. Phasellus gravida vitae lacus sit amet tincidunt.

Aenean egestas metus et magna pretium lacinia. Aenean vitae metus tortor. Sed vel quam quam. Fusce dignissim libero quis varius fermentum. Ut eget porttitor orci, vel porta massa. Aliquam posuere nulla mi, eu vestibulum nisi pellentesque sit amet. Aliquam venenatis tellus eu ipsum faucibus mattis. Phasellus gravida vitae lacus sit amet tincidunt.

Don’t hesitate to reach out at any point. We’re always happy to answer questions, grab a coffee and assist you in any way we can.

Gain immediate access to our newsletter and our latest research on open and embedded insurance.

The Open and Embedded Insurance Observatory performs research and advisory on the global applications of Open and Embedded insurance.